Imagine this: you’re simultaneously standing at the edge of two exciting yet daunting life transformations—launching a home-based business and moving into a new home. Each task on its own requires meticulous planning and unwavering fortitude. What if there was a way to harness the chaos of this dual transition into a symphony of productivity? This […]

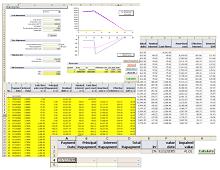

How an Assumable Home Loan Can Make You a Lot of Money?

What is an assumable home loan? This pertains to the transfer of a home loan from the current home owner to a new owner. For some, the interest would be the same or to a new rate. For instance, when John Doe bought a house for half a million dollars at a fixed interest rate […]

Take Auto Loan if you can afford it

Do you need a car for yourself or for your family? Having a car nowadays is part of the necessity especially when the purpose is for cutting short the usual long travels, hence for leisure when you desire to take your family into an out of town or city vacation trips. Indeed, it is more […]

Why Banks Love Credit Card Users?

More and more people are using credit cards. Even during long recession periods or never ending economic crisis, it seems that people cannot stay away from credit cards. There can be advantages of using credit cards, but is it worth the use when you are down to debt? That’s when banks love credit card users […]

Tips to Manage your Budget and Reduce Your Debts

The general rule for living a good life is to make sure that your expenses never pass your income. If you are able to save a certain amount of money every money after meeting your expenses, then there could be nothing better than that. In this article, we will try to learn some ways by […]

How to Choose a Bad Credit Mortgage Refinance Loan

Times are hard. Yes, for everyone. Many people have been forced in filing for bankruptcy or in missing payments even getting reposed. A lot of them have hit bottom and don’t know where to restart from. The good news is that you can always restart and try to rebuild your credit. One of the options […]