More and more people are using credit cards. Even during long recession periods or never ending economic crisis, it seems that people cannot stay away from credit cards. There can be advantages of using credit cards, but is it worth the use when you are down to debt? That’s when banks love credit card users – that is their business and it’s where they get profits.

What could be the reason why people desire to get hold of a credit card? Simply because they can make use of it for purchasing goods and services with a promise to pay their credit card company after a certain period of time depending on the terms and conditions. In turn, the credit card company or the bank will create a revolving credit account and grant the account holder a credit limit that is at all means a credit user’s cash advance, which will be used for paying the merchants for the purchased goods and services.

Indeed, the main benefit of having a credit card is convenience. When your cash is insufficient and you need to buy something your credit card comes in support. Some more advantages are related to the various rewards schemes your credit card may be linked with. Being a card holder you can get reward points and bonuses. Also higher the credit limit, higher the protection and security likewise. Some credit card companies also offer their holders travel insurances, and other benefits.

The downside of credit cards is charges and penalties. That’s when the banks profit on credit card users and that is why they love them. How this is done? When you delay in paying your credit, that’s when they charge you with fees or penalties.

Credit Card holders don’t realize the effect of having a credit. People who can afford to pay can manage it, while a middle class card holder can find it difficult to pay especially when payments are due on time.

Here are the Banks or credit companies’ ways to “steal” your money:

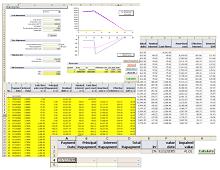

Credit Interest – Banks or credit companies will charge you a certain percentage or interest rate for the late payment. Hence, it accumulates every month when remained unpaid.

Late payment fee – This is another kind of charges or penalties for the late payment or non-payment of the monthly payment aside from the interest charge.

Cash advance fee – Some banks have a charge or fee for the cash advance or a percentage from the whole cash advanced or for other credit companies they impose a transaction fee.

Having said the above, there are still several fees which you as a credit holder must have knowledge of. Keep in mind, that it is best to pay all your credits as per your contract agreement to avoid accumulated credits and added charges.